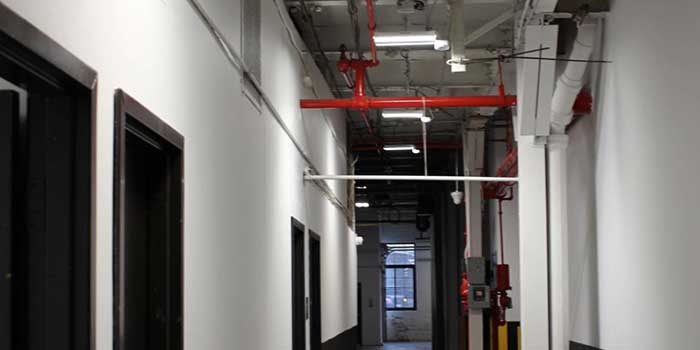

Video MGMT System

Access Control

Access Control

Voice & Data Wiring

Burglar Alarm

Burglar Alarm

Fire Alarm

Fire Alarm

Video MGMT System

Voice & Data Wiring

THOUGHT CENTER > Blog > News

August 20, 2023

Too busy to read? Here’s a summary:

Connecticut home valuations have gone through the roof (pun intended) in recent years because of supply-chain challenges affecting new construction, general inflation, and, of course, all those folks who’ve discovered our idyllic little state during the pandemic.

As appealing as this surge in valuations has been for most Connecticut property owners, it has brought one undesirable consequence: increased insurance premiums.

You’ve probably noticed your premium rising in recent years, but those increases haven’t kept up with inflationary pressure on replacement expenses.

Many carriers are now getting creative to make up the difference.

As a result of the need to catch up with inflation’s effect on replacement costs, some Connecticut carriers will soon require central alarm systems connected with a remote monitoring service before they offer policies associated with replacement values in the range of $500,000-$800,000 or above.

While most Connecticut policyholders will not be required to install monitored alarm systems and other advanced security solutions in 2023, most carriers offer significant discounts to those who nevertheless do.

The exact discount a policyholder is offered depends on the sophistication of their security system and the carrier’s own preferences.

In most cases, Connecticut insurance carriers give their largest discounts—often in the range of 15%–20%—to policyholders who install modern alarm systems and connect them with round-the-clock monitoring services.

When exploring your insurance options, be sure to consult with licensed insurance specialists. They have the knowledge, experience, and access to resources necessary to answer your specific insurance-related questions. In fact, they’ve provided much of the information we’re sharing in this blog post.

Insurers have quite a stake in making sure they encourage the most effective security technologies, which is why they invest millions of dollars in security research every year.

The fact that monitored alarm systems garner the most generous insurance discounts (when they aren’t required outright) is, therefore, a pretty strong indication of their efficacy.

Here’s how remote monitoring works:

When a sensor is triggered, such as a window sensor or a smoke detector, the alarm system activates.

The alarm system sends a signal to the monitoring center, gaining their attention right away.

Most modern alarm systems use cellular signals to communicate with remote monitoring centers. This is because cellular data transmission is possible even when phone lines are down, or the Internet is out.

Upon receiving an alarm signal, the monitoring center will attempt to contact the homeowner to verify the emergency. If they cannot reach the homeowner or if the homeowner confirms the emergency, the center will proceed to the next step.

The monitoring center will contact the appropriate emergency services, such as the police or the fire department, for a speedy response that minimizes losses.

The monitoring center will notify the property owner of any emergency service dispatch.

This communication loop ensures that homeowners know what’s going on when there’s a threat on their property.

In case of a security event, like a fire or a break-in, a monitored security system will promptly alert emergency services to minimize losses.

Knowing your high-value property is well-protected around the clock, especially when you're away, provides peace of mind.

In addition to your home itself, monitored security systems protect valuable assets inside, including irreplaceable items.

By alerting monitoring services to threats like fire or water damage early, monitored systems can prevent severe damage and save big on potential repair and replacement costs.

High-value properties tend to attract more burglars. Monitored security systems not only result in quicker response times when burglaries happen, they act as a deterrent to would-be bad actors, reducing the likelihood of break-ins in the first place.

While advanced security systems can significantly reduce risks, they are not a replacement for basic safety measures, such as locking doors and not smoking cigarettes in bed.

Nobody likes to pay more for insurance or face new policy requirements, and that’s why we’d like to take a deep breath and remember the good news:

New alarm and monitoring requirements are being instated by only a few carriers in 2023, including Hanover in Connecticut, and those requirements rarely affect policies with replacement costs below $500,000.

But what about the good news for you if your replacement costs do trigger new alarm requirements from your carrier?

The good news for you is that you have substantial assets that you should protect with a top-grade, monitored alarm system regardless of your policy.

What’s more, certain losses (your grandfather’s paisley-patterned handkerchiefs, your child’s first teeth, that gold-plated brooch your great-great-grand-aunt stole when she was a housemaid back in Romania, etc.) are irreplaceable no matter how good your insurance policy may be.

And let’s not forget the discounts most insurers offer for security installations—not just the potentially massive discounts for monitored alarm systems but also discounts for certain security cameras, smart locks, and more.

To understand what discounts may be available from your current insurer and how to qualify for them, reach out to your carrier directly.

To compare plans and find a policy that most cost-effectively meets your needs, reach out to licensed insurance professionals in Connecticut. They have the knowledge and resources necessary to help you find the best policy for your unique scenario.

For alarm systems, access control systems, video surveillance systems, and your telecom and security cabling needs, reach out to the friendly security experts at Mammoth Security.

Just fill out the simple form at the bottom of this page, and we’ll reach out to schedule your free site survey and consultation with a knowledgeable member of our team.

NOT COMPLETELY SURE?

860-748-4292Insurance companies usually offer discounts to homeowners who install advanced security systems because they reduce the likelihood of expensive losses.

The amount varies by insurance company, but homeowners could potentially receive discounts ranging from 5% to 20% on their insurance premiums when they install advanced security devices and systems.

Insurance companies value advanced security systems because they reduce the likelihood of claims related to burglary, fire, or water damage. This saves the insurance company money, which can be passed on to the policyholder in the form of lower premiums.

As home valuations rise, the cost to repair or replace the home also increases. This can lead to higher home insurance premiums and even new alarm system requirements for high-value policies.

While the primary purpose of a security system is to protect your home, it can also potentially increase your home's value. Many prospective buyers view advanced security systems as a major amenity.

You should contact your insurance company directly to inform them about your new security system. They may require proof of installation and certificates of service from a remote monitoring company.

Not all systems qualify for discounts. It's best to check with your insurance provider to see which security systems they recognize and the size of the discount you’re likely to receive for a particular system.

In addition to installing an approved security system, you can lower your premiums by increasing your deductible, maintaining a good credit score, and regularly reviewing your policy to make sure that it cost-effectively matches your current needs.