Video MGMT System

Access Control

Access Control

Voice & Data Wiring

Burglar Alarm

Burglar Alarm

Fire Alarm

Fire Alarm

Video MGMT System

Voice & Data Wiring

Banks, credit unions, and other financial institutions require professionally installed monitoring and access control systems for bank-level security.

CCTV cameras, intrusion sensors, access control devices, and other security components should all be carefully selected, customized, and installed to meet the unique security needs posed by your bank's layout and risk assessment.

Bank robberies and other crimes mostly occur at branch offices, where it's rarely cost-effective to have fully staffed surveillance rooms. The good news is that Internet Protocol (IP) cameras transmit video footage over the Internet so that on-site guards have full access to livestreams and recorded footage on their smartphones whether or not there is a nearby surveillance room.

Even better, IP cameras give remote security monitors 24/7 access to live streams and recorded video. This empowers centralized authorities to direct on-site personnel or alert law enforcement when special attention is required.

By capturing crystal-clear images, high-resolution and high-definition bank security cameras provide the detailed situational awareness necessary to detect threats in real-time.

High-def and high-res cameras also provide law enforcement with the evidence they need to track suspects faster and more confidently.

As more bank customers report unauthorized withdrawals, ATM surveillance is more crucial than ever.

High-quality IP cameras at ATMs are instrumental in quickly resolving cases of phantom ATM withdrawals and credit card skimming. They also help banks provide timely resolutions to customers by providing remote monitors with instant access to evidence whenever ATM customers fall victim to fraud.

Digital technology allows for the storage of highly detailed video surveillance footage for longer periods and at higher resolutions than has been possible in the past. This is because digital footage occupies significantly less storage space than standard analog footage from traditional cameras.

Efficient use of storage is beneficial for law enforcement and security personnel, who can review footage from the weeks or months preceding a security breach to identify potential suspects.

With artificial intelligence software, banks can now analyze real-time and recorded video footage for faces, objects, license plate digits, and other evidence.

The very best AI software can assist in detecting suspicious behaviors, such as mannerisms that suggest discreet attention to upper walls and access control points.

When crimes like armed robbery do occur, AI-based video analytics applied to recorded footage enables efficient incident investigations.

AI-supported video management software searches are especially useful because bank robbers often survey sites before attempting heists. Bank footage is, therefore, likely to have images of at least one unmasked perpetrator in storage.

With the aid of AI, even masked criminals can be detected by filtering through past footage for characteristics, such as height, weight, and even shoes and accessories, that match with masked robbers. This method isn't foolproof, but it can be helpful when developing suspect lists.

During non-banking hours, bank security systems should activate professionally installed motion sensors and burglar alarms. These types of sensors work by using technologies like infrared, microwave, or ultrasonic waves to detect movement in their range.

If a bank motion sensor is triggered in a bank after hours, it can trigger an alarm to alert appropriate authorities.

Similarly, motion sensors can be used to detect movement in restricted areas, such as vaults and server rooms.

Bank security is enhanced with access control systems that protect restricted areas like teller stations, vaults, and safes from intruders. These systems employ automatic locking features to prevent unauthorized entry or exit from secure areas while allowing access to authorized individuals with authentic credentials.

Access control systems also protect ATM sites, where enclosed areas around ATM machines can improve customer safety and protect account and transaction data from skimming and phishing.

For the absolute highest level of bank security, select devices that can be integrated for data sharing and easy administrative oversight on a single interface.

By integrating access control, intrusion detection, and surveillance together, a single interface provides administrators and security staff with at-a-glance control over their entire security network.

By sharing data between devices, integrated systems are better able to recognize security threats while producing fewer false alarms. This data sharing results in greater accuracy, early warnings, and improved response times.

A combination of camera models with different strengths should be used throughout your premises to achieve maximum security coverage with the details you need.

Bullet cameras capture high-quality footage and are noticeable enough to deter criminals.

On the other hand, less obtrusive camera models, such as dome cameras, are used to capture footage from unexpected angles that criminals might not anticipate.

License plate recognition cameras are especially useful for parking lots and other areas where criminals may park getaway cars.

To provide complete coverage, bank security cameras should be installed at parking lots, entry points, lobby areas, teller windows, vaults, and ATM locations.

Bank security systems should be designed for scalability and customizations. Scalable systems enable easy additions, and flexible systems enable customizations for individual bank floor plans and risk assessments.

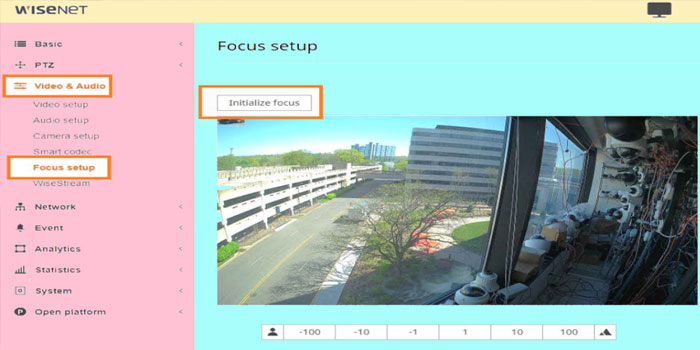

Security systems for banks should be easy to use by administrators and security personnel. Be sure to select a system with an intuitive and simple-to-navigate interface.

There are several reasons that banks, credit unions, and other financial institutions rely on professional security system installations.

Professional security system installers have the necessary expertise and experience to install and configure security systems for banks properly.

They can assess a bank's specific security needs and recommend and install the appropriate security systems to meet those needs.

Banks are subject to various security regulations and standards, and professional installers can ensure that their security systems meet those requirements.

Professional security installations are dramatically more reliable than amateur installations. This is because professionals use high-quality equipment and have the necessary training to ensure that their systems are installed correctly and rigorously tested to make sure they'll function properly.

Banks often have multiple security systems in place, such as access control, video surveillance, and alarm systems. Professional installers can integrate these systems to work together seamlessly, providing a comprehensive and effective security solution.

Professional security system installers should offer ongoing support and maintenance services to ensure that the systems they install continue to function properly over time. This can include regular system checks, software updates, and troubleshooting services.

Use a local installation team like Mammoth Security for the best ongoing support. The experts on our crew have a strong record of dependable, high-quality security system installations.

To control access, monitor sites, collect evidence, detect intrusions, and efficiently search through stored footage, reach out to the team at Mammoth Security. We have the experience and knowledge to design a security system worthy of your customers, employees, and assets.

Wireless

IP Cameras

Wireless cameras are not reliable enough for commercial use yet. Instead, we use purpose-built antennae to connect hardwired cameras on light poles and buildings.

Phone App

For Camera Systems

Watch live or previously recorded footage on any mobile device. Save it to your phone and e-mail it just like any other video or image.

Increased Resolution

Of 4096×2160

4k or 8MP cameras represent the best value at the moment. Depending on your situation, a 30+ megapixel camera can be installed allowing you to read a seat number from the opposite end of a football field.

Employ The Same Technology As These Companies: